Bookkeeping for Retail Businesses Is Complex — Here’s Why

That’s a lot for retail business owners to juggle. Here’s what to consider when developing or outsourcing your retail bookkeeping system for your store(s).

Unique Challenges of Bookkeeping for Stores

Profitability for retail stores largely depends on your inventory’s value. Once you obtain inventory, it remains on your balance sheet as assets until it is sold. The valuation of these assets can vary widely between those two events. You need to track both the cost of purchasing the inventory and also the cost of selling these goods (COGS).

The inventory item is not an expense until it is sold. At the time that it is sold, you must record not only the “sale” but also its “cost”. This makes retail bookkeeping much more complex than for other industries because you must track all sales transactions, returns, and shrinkage individually.

When determining the COGS for each item, your POS system needs to know the “cost” to use for each item. Your POS system needs to be programmed so that it knows the “cost” and also the “sales tax” of each item. When an item is sold, the POS system generates an entry that records the sale price, sales tax, COGS, and tender method. A simple COGS for an inventory item would include the following costs:

- Cost of purchasing the item (ie. the wholesale price of a pair of shoes that will be resold)

- Freight (an estimate or actual cost of shipping the item to the retail business)

With a clear system for retail bookkeeping in place, you can better understand and control inventory costs and optimize your profit margin. Let’s look at the most common methods of inventory valuation — and why you may need an expert to handle these tedious tasks for your business.

Types of Inventory Bookkeeping

Costing Methods

First In, First Out (FIFO)

The FIFO bookkeeping method assumes that the first items you add to your inventory are the first you sell For example, let’s say you buy 15 guitar tuners @ $20 each and then, a few weeks later, buy another 15 @ $22 each. When you start selling them, the 1st 15 will be sold with a COGS of $20 and the 16th one you sell will use $22 as the COGS.

Last In, First Out (LIFO)

As the name suggests, the LIFO method is the opposite of FIFO. Your POS system will always choose the cost of the most recently purchased item. So with the example of the guitar tuners, if the 1st sale you make is “after” purchasing all 30 tuners, the cost of the 1st tuner sold will be $22. If, when you sell the 16th one, you haven’t purchased any additional tuners, then its COGS will be $20.

Weighted Average

Finally, the weighted average method uses the average cost of all the items available to sell. Using the same example as for FIFO and LIFO, if you sell 1 tuner after you purchase both sets of tuners, the cost used would be $21 (($20 X 15) + ($22 X 15))/30.

Inventory Values on the Financial Reports

The balance sheet will show the total value of your inventory. The inventory chart of account builds when you record each purchase bill into the accounting program. Inventory is moved from the inventory account to the COGS account once the data from the POS system is recorded into the accounting program. The COGS account is found on the Profit and Loss report.

Key Elements of Retail Bookkeeping

In addition to inventory accounting, you must have reliable systems for managing your other expenses and income.

Point-of-Sale and Inventory Management

Retail businesses need a POS system that will track their sales and manage their inventory. There are many good systems available. The one you choose will need to work well for your type of retail business. Your sales staff will need to be well-trained on how to use it so that few data entry errors occur.

Expense Tracking

Every expense incurred to run any business needs to be recorded. Below is a list of the typical expenses for a retail business:

- Payroll (wages, source deductions, workers’ compensation, benefits)

- Rent

- Utilities (hydro, telephone, internet)

- Accounting and bookkeeping fees

- Asset purchases – all the “bigger” items that you purchase that will be around for a while such as:

– Computer equipment

– Display cases

– Company vehicle

- Office expenses (receipt paper, plastic bags)

Source documents for every single expense incurred need to be available for review by the CRA at any given time. Collecting and storing all expense receipts can be challenging, but thanks to programs like Xero and DEXT, this is much easier than it used to be!

Loan Tracking

Many retail business owners need significant startup capital. Any business loans need to be set up in the accounting program and the loan repayments must be recorded with a split between the “interest” and “principal” so that your financial reports will always show the true balance owing on your loans.

Staying on top of your debt can boost your credit rating and open up larger credit lines with better rates in the future.

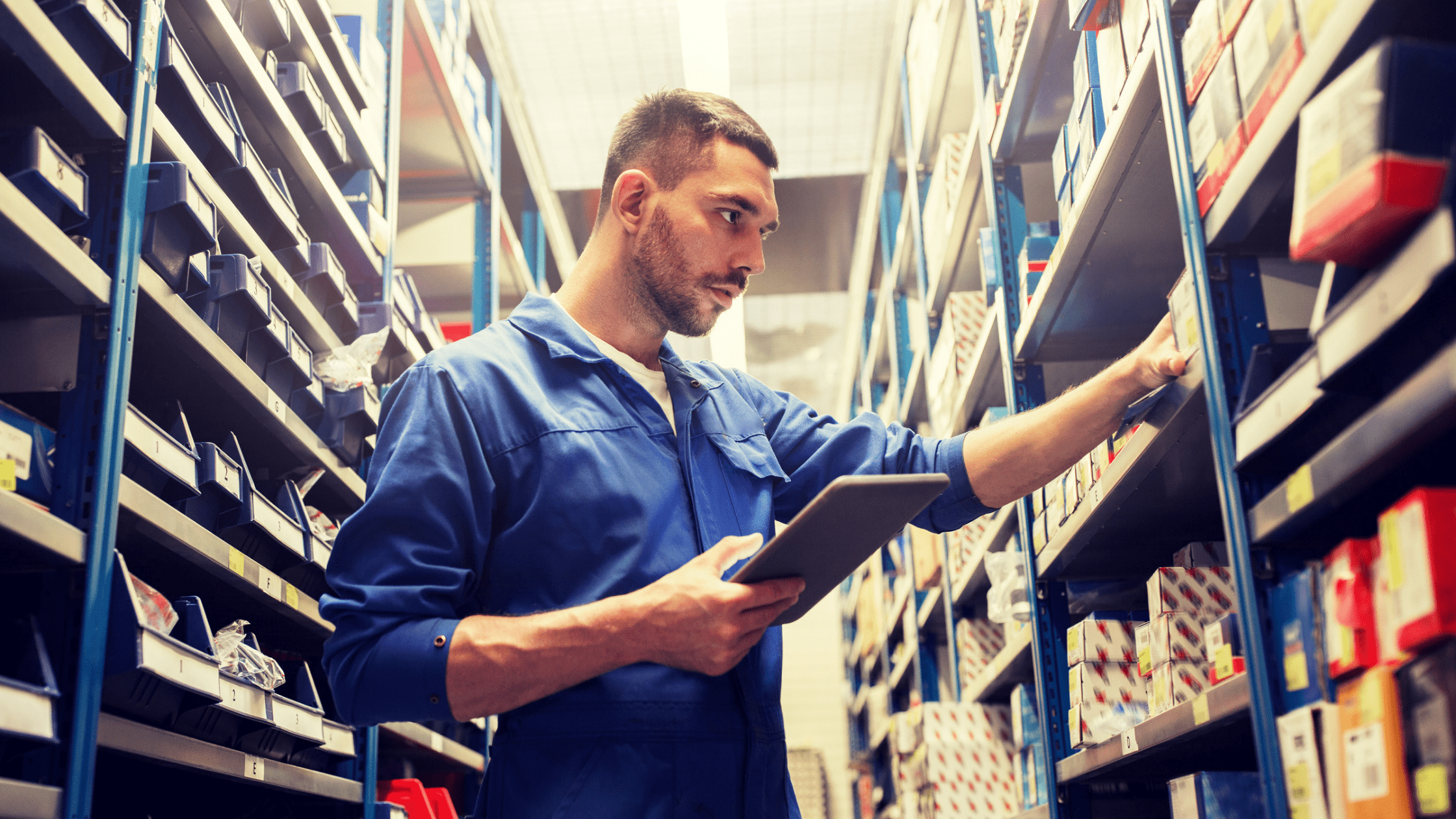

Inventory Counts

Even the most sophisticated POS software can’t account for hidden shrinkage, mis-entered transactions, and other discrepancies. It’s important to do a physical count at least once a quarter. Ensure that your inventory matches what’s in your POS system. You also need to compare the detailed inventory value from your POS program to the value of the inventory on the balance sheet.

Conclusion: Retail Bookkeeping Requires Immense Attention to Detail

You can either hire an in-house bookkeeper to handle retail accounting or outsource to a third party. Here’s a handy calculator to compare the costs of each.

For detailed, flawless bookkeeping systems that protect your retail business, reach out to eGO Bookkeeping. We specialize in retail accounting. Request a quote now.

Did you enjoy this article? You might also enjoy…

Five Ways to Spring Clean Your Bookkeeping