The Ultimate End-Of-Day Procedures System for Retail (+Free Template!)

There is much more room for error in these environments than in industries such as construction, where invoicing is done less frequently and on a larger scale as compared to retail, and where invoicing and receipt of payment are typically handled solely by the owner or office administrator.

This article will cover what end-of-day procedures are, why end-of-day is essential to your business and how eGO Bookkeeping can help you implement and manage these processes.

What Is An End-Of-Day Procedure?

Retail businesses typically track sales and inventory through a point-of-sale (POS) program. Employees enter the items or services a customer wishes to purchase, and the POS calculates the taxes and totals the items. Most POS systems also record the payment type, whether it be cash, debit, credit card, or gift card. The employee receives cash or takes payment through a debit & credit card terminal. The POS can produce a variety of reports based on these sales and tender records. At eGO Bookkeeping, we rely on the accuracy of these reports when recording your revenue and HST collected, which you see on your financial statements.

You probably already have some closing procedures in place. Tills need to be counted, and floats prepared for the next day. Most payment terminals need to be closed daily to trigger the deposit of funds into your bank account. Depending on the program, some POS programs also need to be closed out and may require you to record cash and payment terminal totals into the POS. Many businesses will print out daily summaries of the transactions that were processed through the terminal for their records.

Checking Recorded Sales With A Simple Spreadsheet

How To Use The Spreadsheet

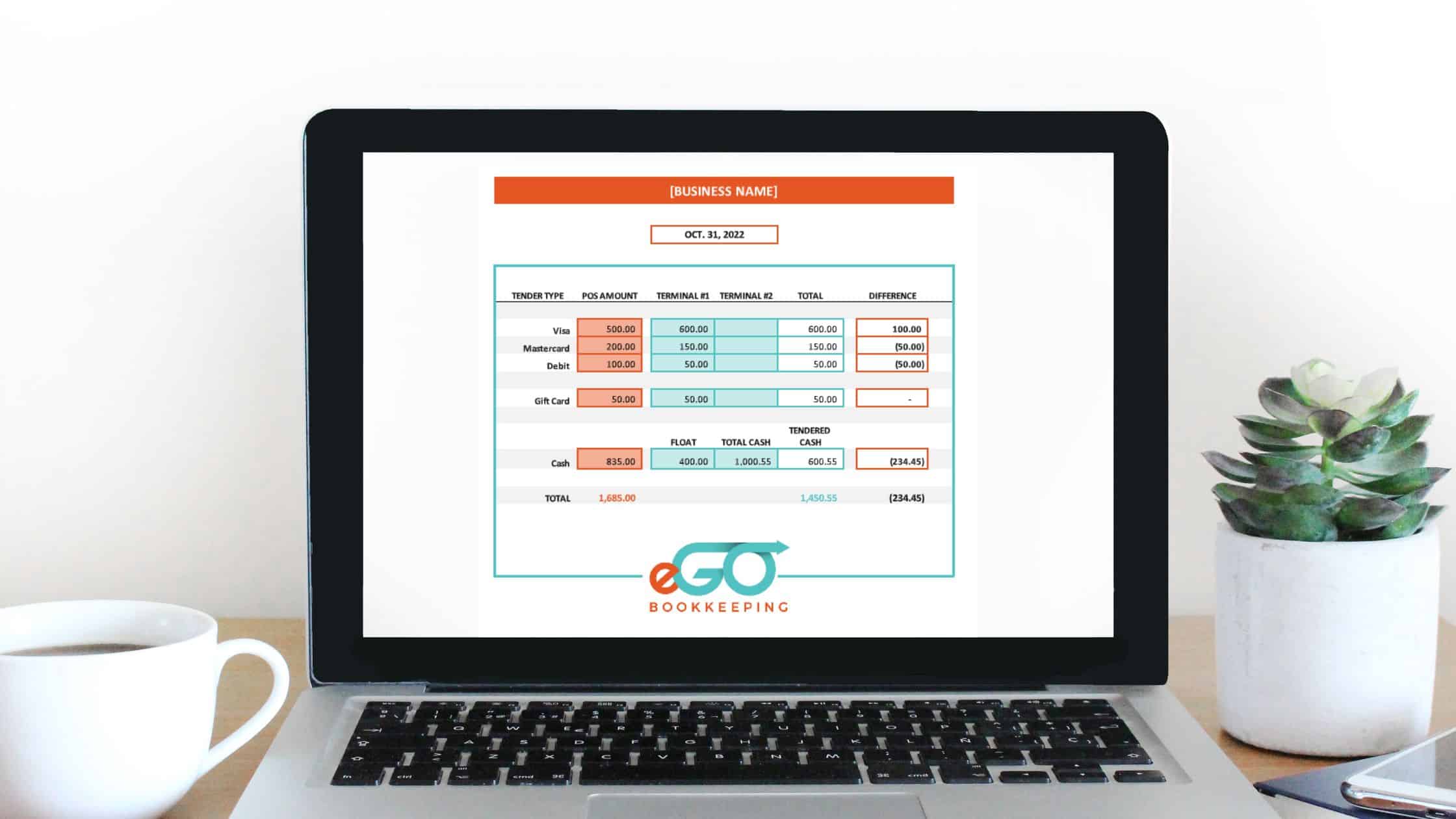

To begin, you will need to fill in the coloured cells. POS figures are recorded in the column titled “POS AMOUNT” (Column C, the orange cells). These are comprised of your total sales for the day and are the amounts you are expecting to receive. Notice that these amounts are separated by payment type and by card type. This makes it easier to identify problems.

Actual amounts are your cash and the totals from your payment terminals (Columns E & F, the turquoise cells). Count all of the cash you have at the end of day, including your float and enter it in the “TOTAL CASH” column (Column F).

In Column E, “FLOAT”, record the float amount that you started with at the beginning of the day. The spreadsheet will automatically subtract the float amount from the total amount cash, leaving you with the amount tendered for the day. The spreadsheet will also calculate the difference between the tendered cash and the POS cash amount. Payment terminal amounts are broken down by terminal and are recorded in Columns E & F. Notice that these are totaled automatically in the “Total” column (Column G). This is the amount of money that you actually received.

The difference between what you actually received (column H) minus what your POS expected (Column C) is recorded in the “Difference” column. In a perfect world, these amounts will be identical, and the difference will be zero. However, when they don’t match, the difference will tell you how much the “out” is and whether you have received too much money or too little. You may then be able to identify where the error occurred and even why it occurred. More importantly, you will have an accurate record of how much money was received.

So Why Do These Procedures Matter?

Identify Problems Before They Build Into Bigger Issues

By comparing POS reports with actual figures on a daily basis, you can pinpoint a number of problems and mistakes and take steps to correct them before they build into more significant issues. Most of these errors directly affect your cash on hand. Regularly and accurately recording the amount of money received into the business means you will always know exactly how much money you have available for expenses like paying bills, staff, or purchasing new inventory. You’ll also know what you have left over that can be used for other things like updating equipment or growing your business.

Implementing simple procedures to increase the accuracy of your records decreases the chance of being audited. If you do get audited, your records will be clean and ready to be presented. You won’t need to scramble gathering documents or trying to remember what happened “that one time” six months ago.

Ensure Accurate Records For Potential Investors and Buyers

Establish Accountability and Greater Accuracy For Your Staff

By assigning end-of-day tasks to your sales staff, you are establishing accountability. Seeing firsthand where mistakes occur can prompt staff to strive for greater accuracy. In addition, they may become aware of errors they didn’t know they were making.

Prevent Tender “Flips”

One of the most common mistakes we see is tender “flips.” This happens when someone records a payment by the wrong tender type. For example, when payment is made by visa but is recorded as debit. Flips are easy to identify and don’t cause any major problems. These can be occasional careless mistakes, but if they are frequently happening, it might indicate that an employee is rushing or not paying enough attention to their work.

Flips involving gift cards are trickier. If a sale is tendered in the POS as a gift card, but the customer paid with debit, your gift card liability account will appear less than it actually is. While this may not seem like a big deal, it does affect your Balance Sheet, which is key in monitoring the financial health of your business.

Another type of flip can be more significant – when digits get transposed. Many POS systems communicate directly with the payment terminal, but some require the employee to input the total manually. Mistakes in this step can result in a significant short at the end of the day – or worse, an overcharging of your customer. For example, if the sale totals 92.72 and an employee keys in 29.72, you’re out $63 at the end of the day. Catching these errors quickly can help identify employees who might need additional training or need to slow down when processing sales.

Identify Missed Or Incomplete Sales

Prevent Theft

Consistent monitoring of cash intake is helpful for theft control. When cash is being counted regularly, it increases the likelihood of a potential thief being caught. That knowledge decreases the temptation to steal in the first place.

How Can eGO Help You Implement These Procedures?

One of the biggest deterrents to effective end-of-day procedures can be staff scheduling. We recommend scheduling one person each day as a designated closer and assigning end-of-day responsibilities to them. If too many people are involved, it can get messy and vital information is more easily missed. To ensure they have enough time to complete their count and record sales accurately, we recommend scheduling their shift end for at least 15 minutes after the business has closed. The most common end-of-day employee complaint is that they’re stuck at work after their shift has ended (and they are no longer being paid), counting the till, and filling out paperwork. This can lead to rushing, resulting in miscounting and other mistakes.

Summing It Up

By working with your team to implement a simple end-of-day count, you can reduce errors and significantly increase the accuracy of your reports. When your data is reliable, you can trust your reports and rest assured that you are making financial decisions with up-to-date, precise information.

It is crucial to have accurate numbers when making financial decisions for your business. Outsourcing your bookkeeping to professionals like the eGO team ensures that precision. In addition, hiring a team like eGO frees up your time to build your business and allows you to serve your customers with the reassurance that your bookkeeping is always up-to-date.

Whether building your business or making routine financial decisions, it is vital to know how much money you have available. End-of-day procedures are a pivotal way to track money coming into your business and ensure you are on the right track for growth!

Did you enjoy this article? You might also enjoy…

Is It Time to Move Your Bookkeeping to the Cloud?

What Happens When You Outsource Your Bookkeeping and Payroll Services?